Everything you need to know about Paramount’s hostile bid to keep Warner Bros. from Netflix.

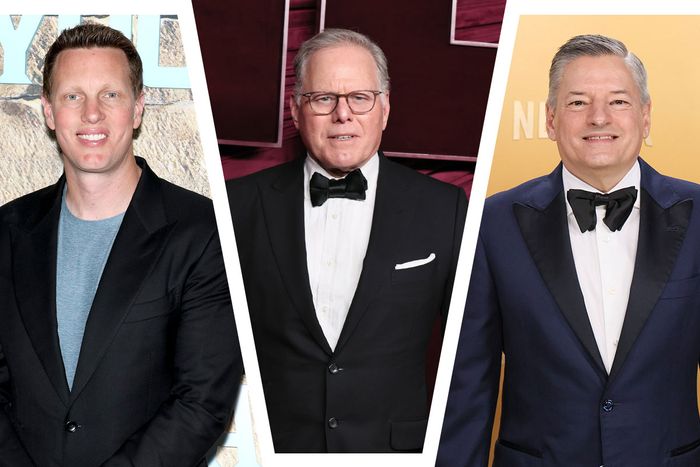

Photo-Illustration: Vulture; Photos: Arturo Holmes/WireImage, Rodin Eckenroth/Getty Images

Having presumably choked on splashy “Netflix buys Warner Bros.!” headlines all weekend, Paramount Skydance battled back Monday morning with news of its own: The David Ellison–led company is launching a hostile takeover bid for Warner Bros. Discovery. “We’re really here to finish what we started,” Ellison told CNBC. Having lost the initial bidding war to CEO Ted Sarandos at Netflix, Ellison will appeal directly to WBD’s shareholders with the exact same offer the company’s board rejected last week. After decrying that bidding war as “tainted” in a letter sent by lawyers last week, David Ellison, no. 1 boy of centibillionaire Oracle exec Larry, has gone full Kendall Roy on the situation. Let’s break down what it means for WBD, Netflix, and Paramount going forward.

Yes and no. To recap, Warner’s board agreed to Netflix’s $82.7 billion offer to buy its “streaming and studios” — a carve-out that encompasses HBO and HBO Max, WBD’s 100-year-old IP library, and assets like Batman and the Harry Potter movies, and related subsidiaries like DC Comics, WB Games, and a global parks and experiences business. Ellison’s offer, which totals $108.4 billion and which he will now put in front of WBD’s individual shareholders, is to buy all that plus WBD’s cable networks, a shrinking but still significant business that includes CNN, TNT, TBS, and several other networks. But the deal must still pass regulatory approval.

If you’re new to hostile takeovers, Disney Ellison is deploying something called the “tender offer” strategy. Basically, if more than 50 percent of shareholders think he has a better offer and vote against the board’s recommendation to sell to Netflix, the top streaming service could ultimately lose the company to Paramount. There’s an associated $2.8 billion break-up fee for WBD if it doesn’t ultimately side with Netflix, something either WBD or Paramount will have to foot the bill for if the hostile takeover proves successful.

Sarandos is playing it cool, Deadline reported. “Today’s move was entirely expected,” the Netflix CEO said this morning at a conference in New York, where he took some questions. “We have a deal done, and we are incredibly happy with the deal. It’s great for shareholders, great for consumers. We think it’s a great way to create and protect jobs in the entertainment industry,” he added.

Paramount’s offer — its fourth in an aggressive bidding war that ran through Thanksgiving weekend — was richer, but ultimately lost in front of WBD’s board, and is the same deal on the the table now. “We are offering shareholders $17.6 billion more cash than the deal they currently have signed up with Netflix,” Ellison told CNBC. “We believe when they see what is currently in our offer, then that’s what they’ll vote for.”

For its winning bid, Netflix offered $23.25 cash per share plus $4.50 in stock, and Sarandos, per Bloomberg, tried to woo Trump in the negotiating process. By comparison, the Paramount bid is an all-cash offer priced at $30 a share. Added up, Paramount’s offer may top Netflix’s by $25.7 billion, but the board likely reasoned that after being spun off, the cable assets would be worth more than the difference and that Netflix made the stronger offer for the streaming and studios business the better buyer.

But Ellison has positioned himself better suited to get a deal over its regulatory hurdles, in part thanks to his own family’s proximity to the Trump administration. We haven’t even gotten to the part about how Jared Kushner’s helping him finance this thing.

Surprised? Everyone’s least favorite in-law-in-chief heads one of the firms helping Ellison finance his bid. The Paramount bid is additionally backed up by the Ellison family, banks, and the sovereign wealth funds of Saudi Arabia, Qatar, and Abu Dhabi, and private equity firms like Affinity Partners, which was founded and is led by Kushner since the end of the first Trump administration. Affinity’s come under lots of scrutiny since its founding, since so much of its funds from the Public Investment Fund, a.k.a. the Saudi sovereign wealth fund.

It depends on whom you ask. Paramount has promised to prioritize the theatrical experience and release more than 30 films to theaters annually if the company were to swallow up Warner Bros. Discovery — and it seems to emphasize blockbuster cinema: Avatar director James Cameron, who worked with David Ellison on the release of Terminator: Dark Fate, praised him on The Town podcast recently as “the best possible choice” to lead the company. Paramount would likely super-charge its comparatively weak streamer Paramount+ with the libraries of HBO Max and 100 years of Warner Bros. programming.

At the same time, there is no scenario in which a Paramount acquisition does not result in catastrophic layoffs for Hollywood. As industry observers have noted, the Paramount deal would smash together two companies that both own cable assets, both own studios, both own streaming services, and both hold a massive stake in television news output. A Netflix purchase, despite the fact that it has no theatrical track record and it would be swallowing up a major studio and streaming competitor, represents some upside, in that many of the other assets it would buy feel genuinely additive. Republicans, Democrats, and Hollywood’s unions, have all already raised anti-competition concerns of the Netflix sale, but no dispassionate observer could say a potential Paramount acquisition wouldn’t raise similar concerns.

Over the weekend, President Trump said the resulting market share it would obtain over streaming “could be a problem” and vowed that he’d “be involved” in reviewing it. But he also praised Netflix and called Sarandos, who has chummed it up with the president over dinner at Mar-a-Lago, “fantastic,” and confirmed he met with the Netflix CEO at the White House as the company secured its deal. The president has a longstanding friendship with Larry Ellison and his son-in-law is enmeshed in the financing of the Paramount bid, and the younger Ellison has already made Trump-friendly moves as the head of Paramount, including installing Bari Weiss as president of CBS News and reviving the Rush Hour franchise. It’s starting to sound like a fair review of the potential antitrust implications of one of the biggest media and entertainment mergers of all time should perhaps not involve a president with skin in the game. And yet!

A deal of this size will be scrutinized by the Department of Justice as well as state attorneys general on antitrust grounds and will likely require approval from the European Commission, as well as other governments around the world. All of that applies to Paramount’s hostile takeover, too, but to hear Ellison tell it, he and his company have “a more certain and quicker path to completion,” as he noted in his CNBC interview today.

It’s important to remember that not every hostile takeover is Elon Musk buying Twitter. Ellison’s bid could still float into WBD shareholders’ inboxes like a brick parachute. But for now at least he and his family have the money and the will to keep fighting for control.