YOU TRUSTED THE BOT. NOW YOUR BANK ACCOUNT IS BEING DRAINED.

The Federal Trade Commission has just dropped a BOMBSHELL lawsuit, revealing an alleged digital TRAP that has already ensnared HUNDREDS OF THOUSANDS of people. It all starts with a friendly, AI-powered chatbot named “Pearl.” You search for help—legal advice, health answers, simple fixes—and “Pearl” promises answers. But the real answer is a devastating monthly bill you never saw coming.

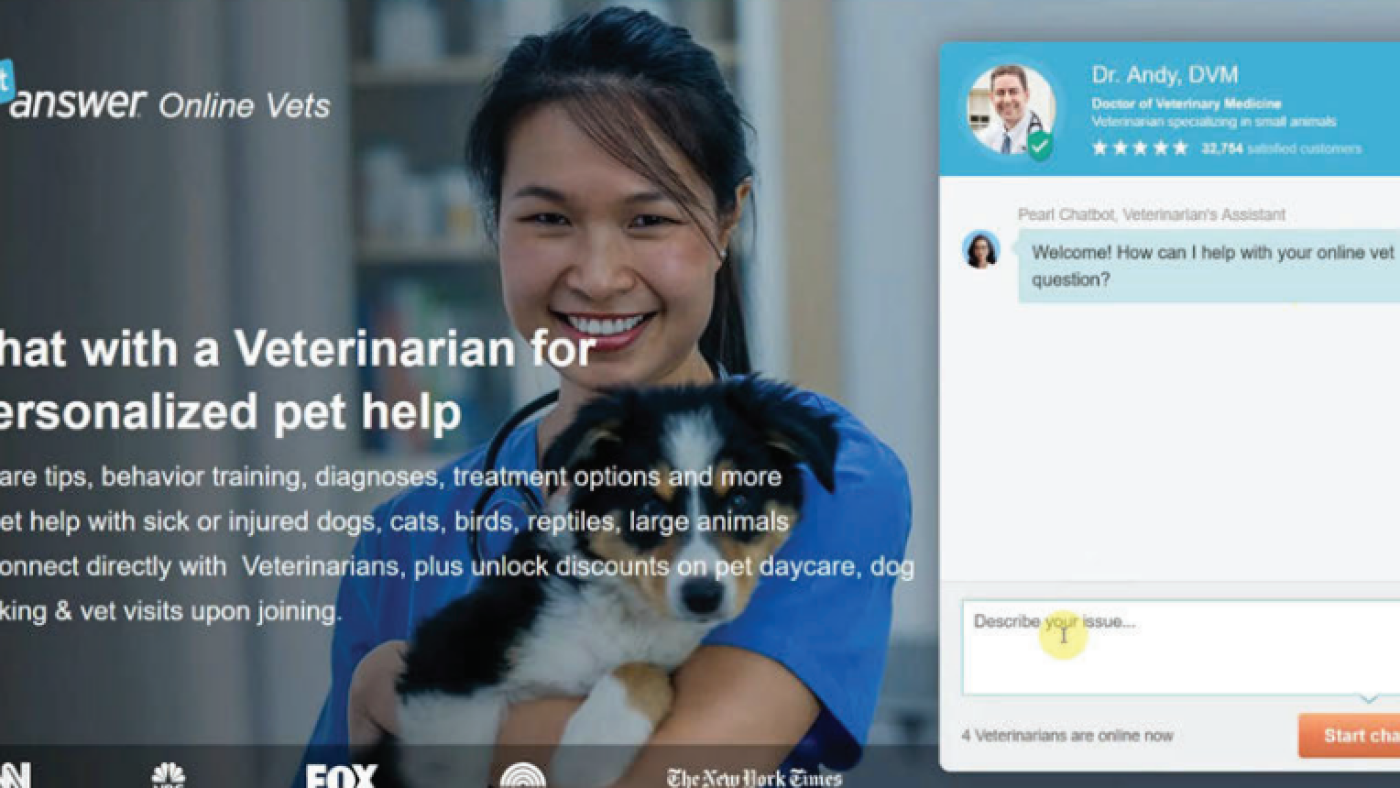

Here’s the alleged SCAM, spelled out in the FTC’s own complaint. You click an ad and land on sites like JustAnswer.com or AskALawyer.com. The chatbot asks questions, then offers “help” for a “$1 to $5 join fee.” You enter your card. THEN THEY STRIKE. Buried in microscopic text—RIGHT ABOVE A BIG, ORANGE “CONFIRM NOW” BUTTON—is the truth: you’ve just signed up for a crushing monthly subscription, charging you up to $79. EVERY. SINGLE. MONTH. The charges keep coming until YOU fight to cancel. The suit claims CEO Andy Kurtzig KNEW about the deception and REFUSED to stop it.

This isn’t a bug—it’s the BUSINESS MODEL. Experts call these “dark patterns,” a slick term for corporate TRICKERY designed to fleece regular people. The FTC says JustAnswer’s practices are “rampant consumer deception.” This is the same playbook used by giants like Amazon, now weaponized by a company with 700 employees and $50 million in funding. While they rake in cash, who pays? You do. Every time you miss the fine print they designed for you to miss.

They’re watching you scroll, knowing you’ll click, and betting you won’t notice the money leaving your account until it’s too late.

Edited for Kayitsi.com